Payday loans have become a common option for those in need of quick, short-term financial assistance. When an emergency arises, you may find yourself searching for fast cash to cover unexpected expenses, and services like Eloanwarehouse can provide a solution. This online lending platform specializes in payday loans, offering immediate access to funds with a simplified application process. In this detailed guide, we will dive into everything you need to know about Payday Loans Eloanwarehouse, the application process, and important considerations like loan terms, interest rates, and potential loan alternatives.

What Are Payday Loans?

Payday loans are short-term loans designed to provide emergency financial relief. They typically offer instant loan approval, allowing borrowers to access funds quickly, often within the same day. Unlike traditional loans, payday loans are generally smaller amounts with short repayment periods—usually due by the borrower’s next payday. This makes them a go-to option for those who need fast cash but may not have time to go through the more lengthy processes associated with traditional loan providers.

When considering payday loans, it’s important to understand that they are not long-term solutions. They are best suited for people who need temporary financial help to cover unexpected costs like medical bills, car repairs, or utility payments.

How Does Eloanwarehouse Work?

Eloanwarehouse offers a seamless online lending experience, making it easier than ever to access fast cash loans. The platform specializes in payday loans and provides a straightforward loan application process that can be completed from the comfort of your own home.

The Loan Application Process

To apply for a payday loan with Eloanwarehouse, all you need to do is:

- Visit the Website: Go to the Eloanwarehouse platform and fill out a simple loan application form. The online application asks for basic personal and financial information, such as your employment status, income, and contact details.

- Instant Loan Approval: Once you’ve submitted the form, you will receive an immediate decision. Eloanwarehouse typically approves payday loans quickly, so you’ll know whether you’ve been approved within minutes.

- Receive Funds: If approved, the loan amount is directly deposited into your bank account. In many cases, funds are available within one business day, allowing you to address your financial needs without delay.

Flexible Loan Terms

Eloanwarehouse provides borrowers with flexible loan terms. While payday loans are usually due in full on the borrower’s next payday, the specific repayment period can vary depending on the loan terms and the borrower’s preferences. It’s essential to understand your repayment options before committing to any loan to avoid additional fees or penalties for late payments.

Key Features of Payday Loans Eloanwarehouse

1. Quick Loans for Urgent Needs

One of the biggest benefits of payday loans is their speed. Whether you need to cover an emergency medical bill, car repairs, or other unexpected expenses, Eloanwarehouse provides a fast way to secure the funds you need. With an instant loan approval process, the entire transaction—from application to funds in your account—can happen within a matter of hours.

2. Minimal Paperwork and Fast Approval

Payday loans require less documentation compared to traditional loans. Eloanwarehouse’s online platform streamlines the application process, requiring only basic details to verify your eligibility. For many borrowers, this means faster approval and less hassle.

3. No Credit Score Requirements

Unlike many traditional loan providers, payday loans typically do not rely heavily on your credit score. This opens up borrowing opportunities for individuals who may have poor or no credit. As long as you meet the basic eligibility requirements, such as proof of income, you can still qualify for a loan.

4. Borrowing Money Made Easy

One of the main reasons people opt for payday loans is the simplicity of borrowing money. Eloanwarehouse’s online loan services allow you to apply from anywhere, anytime, making it convenient to access funds quickly. The easy application process ensures that you won’t waste time gathering documents or dealing with lengthy procedures.

5. Emergency Loans for Unpredictable Situations

Life is full of surprises, and not all of them are welcome. Whether it’s an urgent medical bill or a car breakdown, emergency loans help you deal with unexpected financial burdens without stress. Eloanwarehouse offers the convenience of securing funds without a lengthy approval process, so you can focus on resolving the issue at hand.

Risks and Considerations of Payday Loans

While payday loans can provide fast financial relief, they also come with several important risks and drawbacks that should be carefully considered before borrowing.

High Interest Rates

One of the biggest downsides of payday loans is the interest rates. Payday loans typically have much higher interest rates compared to other forms of borrowing. This is one reason why payday loans are often seen as a last-resort option. It’s important to understand the full cost of borrowing and evaluate whether the loan is truly the best solution for your situation.

Short Loan Terms and Repayment Pressure

Payday loan terms are typically short, meaning you may need to repay the loan in full as soon as your next payday. While this short-term borrowing is convenient, it can also create pressure on your finances. If you’re unable to repay the loan on time, you may incur additional fees or penalties, which could make your financial situation even more difficult.

Debt Cycle Risk

Another concern is the potential for borrowers to fall into a debt cycle. If you are unable to repay your payday loan on time, you may be forced to borrow again to cover the outstanding balance. This can quickly escalate into a cycle of debt that becomes harder to manage, especially if payday loans are used repeatedly without a clear plan to pay them off.

Loan Alternatives

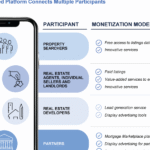

Before committing to a payday loan, consider other loan alternatives that may be more affordable and flexible. Some options include:

- Personal Loans: Traditional personal loans often offer lower interest rates and longer repayment periods compared to payday loans.

- Credit Cards: If you already have a credit card, it may be a better option for financing short-term expenses at a lower cost.

- Borrowing from Friends or Family: If possible, borrowing from family or friends can provide a more affordable solution without high interest rates.